It is possible for banks to garnish wages without a court-order if you have significant credit card debt. However, there are exceptions to this rule and you can take steps to avoid such actions. A lump sum payment can be made to your debt collector to reduce the amount of money owed. Also, you should review the laws in your state regarding bank account levies.

Can banks garnish wages in lieu of a court order?

Banks can garnish wages in two ways. They can garnish wages without a court or administrative order. The other option is "interim relief." Interim relief allows the bank to retain the garnishment until a court orders is issued. The bank can then rescind the garnishment order and collect the funds. The person can ask for a hearing if he wishes. This can be done by sending a written request to court. It should include the reason for the dispute. The court will schedule an appointment for a hearing within twelve days. If the request does not reach the court within the specified time, the garnishment will be cancelled. A continuance must also be granted and the hearing must take place within 12 working days.

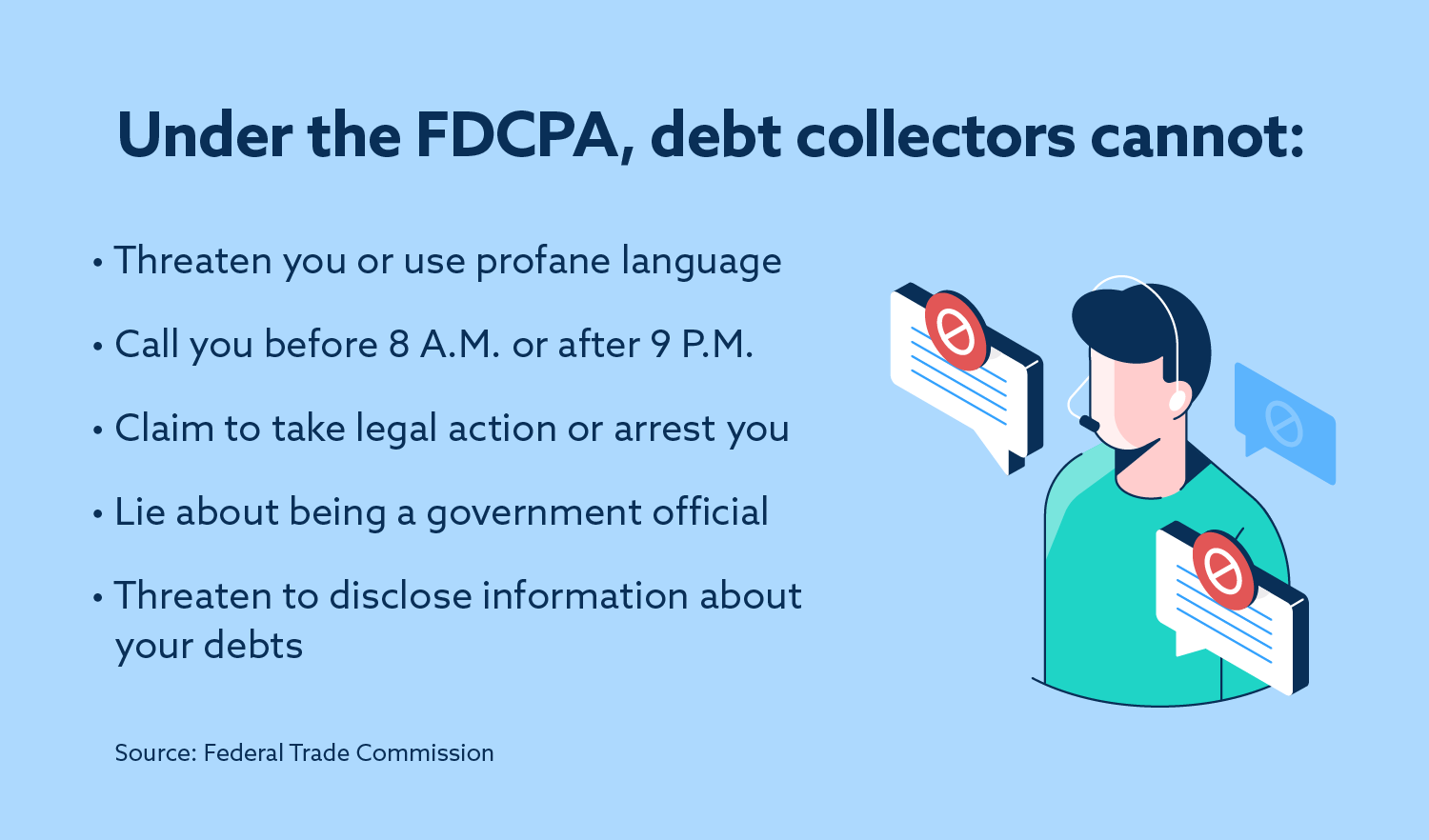

There are exceptions to the rule. First, creditors cannot garnish wages if you receive government support payments. These include alimony and child maintenance. Also included in support payments are retirement benefits, workers compensation, disability benefits and social security. If the bank can prove that the money was directly taken from your wages, it cannot garnish your paychecks.

Can they garnish wages in order to provide child support?

While federal law allows for the government to garnish wages and not need a court ruling, there are stricter rules in some states. They can garnish up 50% of the net earnings of debtors who are unable pay their child support payments. The child support debtor can also garnish up to 60% if they are behind in their child support payments for more then 12 weeks. In most cases, the state will inform the employee that garnishment will take place. The garnishment amount cannot exceed 30 times the minimum wage.

California courts may issue child support orders. The state must then deduct that amount from the individual's pay. However, if the order came from an Idaho court, the court will deduct only the amount necessary to cover Idaho state and federal taxes. Further punishments may be issued if the court is unable to collect these payments. These could include your driver's licence being suspended or your passport being revoked. Other punishments could include property liens or jail sentence.

Can certain bank accounts be exempted form garnishment?

Bank account garnishment enables creditors to access your wages or bank accounts and take money. It is when a court has entered a judgment against your and orders you to repay the debt. Some bank accounts are exempted from garnishment due to the state law protecting them. You can also get worker's comp, child support, and unemployment benefits.

You can get your bank to verify that you have an account exempted from garnishment. You must be able to provide proof that you actually own the money in the account. You can submit your child's signature or bank statements in certain cases.

Which states allow bank account levies

Bank account levies are a way to collect debt. They allow creditors to seize funds from your bank account. You should be aware that these levies can only be applied to bank accounts if you are not in compliance with the law. Levies can be applied against your account only if you have outstanding debt. Levy laws can change at any time. You can also fight bank levy by getting in touch with your bank and informing them.

A bank account lien can be used to collect past-due monies. It can begin as soon as one missed payment has been made or it may take place several months later. You will need to show proof of your debt in either case. Laws regarding levy vary from one state or another, and are subject to frequent changes. It is a good idea for you to seek out the assistance of an attorney if your situation is complicated.

FAQ

What is personal financial planning?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. It involves understanding where your money goes, knowing what you can afford, and balancing your needs against your wants.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You don't need to worry about monthly rent and utility bills.

You can't only learn how to manage money, it will help you achieve your goals. It will make you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finance anyway? Everyone does! The most searched topic on the Internet is personal finance. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. Only two hours are left each day to do the rest of what is important.

If you are able to master personal finance, you will be able make the most of it.

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income is earned through hard work and effort.

Active income is when you create value for someone else. You earn money when you offer a product or service that someone needs. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great because you can focus on other important things while still earning money. But most people aren't interested in working for themselves. They choose to make passive income and invest their time and energy.

Problem is, passive income won't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. Start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

How can a beginner make passive income?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You might even have some ideas. If you do, great! You're great!

Find a job that suits your skills and interests to make money online.

You can create websites or apps that you love, and generate revenue while sleeping.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. That way, you'll stick with it long-term.

Once you've found a product or service you'd enjoy helping others buy, you'll need to figure out how to monetize it.

There are two main options. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

In both cases, once you have set your rates you need to make them known. You can share them on social media, email your list, post flyers, and so forth.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

Be a professional in all aspects of marketing. You never know who could be reading and evaluating your content.

-

Know what you're talking about - make sure you know everything about your topic before you talk about it. Fake experts are not appreciated.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. Do not send out a recommendation if someone asks.

-

Use a good email provider - Gmail and Yahoo Mail are both free and easy to use.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Learn and keep growing as a marketer to stay relevant.

How to build a passive stream of income?

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

Understanding their needs and wants is key. This requires you to be able connect with people and make sales to them.

The next step is to learn how to convert leads in to sales. The final step is to master customer service in order to keep happy clients.

You may not realize this, but every product or service has a buyer. If you know the buyer, you can build your entire business around him/her.

You have to put in a lot of effort to become millionaire. It takes even more work to become a billionaire. Why? Why?

And then you have to become a millionaire. You can also become a billionaire. The same is true for becoming billionaire.

So how does someone become a billionaire? Well, it starts with being a thousandaire. You only need to begin making money in order to reach this goal.

You must first get started before you can make money. Let's now talk about how you can get started.

What are the top side hustles that will make you money in 2022

To create value for another person is the best way to make today's money. If you do this well the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. Your mommy gave you life when you were a baby. Learning to walk gave you a better life.

As long as you continue to give value to those around you, you'll keep making more. The truth is that the more you give, you will receive more.

Value creation is an important force that every person uses every day without knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In fact, there are nearly 7 billion people on Earth right now. Each person creates an incredible amount of value every day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

It means that if there were ten ways to add $100 to the lives of someone every week, you'd make $700,000.000 extra per year. That's a huge increase in your earning potential than what you get from working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every day there are millions of opportunities for creating value. This includes selling products, services, ideas, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. The ultimate goal is to assist others in achieving theirs.

If you want to get ahead, then focus on creating value. You can start by using my free guide: How To Create Value And Get Paid For It.

Why is personal financial planning important?

Personal financial management is an essential skill for anyone who wants to succeed. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why should we wait to save money? What is the best thing to do with our time and energy?

Yes, and no. Yes, because most people feel guilty if they save money. You can't, as the more money that you earn, you have more investment opportunities.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

To become financially successful, you need to learn to control your emotions. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

You may also have unrealistic expectations about how much money you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

For cash flow improvement, passive income ideas

There are many ways to make money online, and you don't need to be hard working. There are many ways to earn passive income online.

There may be an existing business that could use automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

Automating your business is a great way to increase its efficiency. This will enable you to devote more time to growing your business instead of running it.

A great way to automate tasks is to outsource them. Outsourcing allows you and your company to concentrate on what is most important. When you outsource a task, it is effectively delegating the responsibility to another person.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

Turn your hobby into a side-business. A side hustle is another option to generate additional income.

Write articles, for example. You can publish articles on many sites. These sites pay per article and allow you to make extra cash monthly.

Also, you can create videos. You can upload videos to YouTube and Vimeo via many platforms. You'll receive traffic to your website and social media pages when you post these videos.

Another way to make extra money is to invest your capital in shares and stocks. Investing stocks and shares is similar investment to real estate. Instead of renting, you get paid dividends.

As part of your payout, shares you have purchased are given to shareholders. The amount of your dividend will depend on how much stock is purchased.

If you sell your shares later, you can reinvest the profits back into buying more shares. This will ensure that you continue to receive dividends.