It is crucial to know your rights when you are sued in relation to credit card debt. A debt collection agency might use strong-arm tactics to harass your. It may even mislead about the amount of your debt. A lawyer will be necessary to protect your rights in such cases. Certain rights are available to you, as outlined in your credit card agreement.

If you are sued by a credit card company for debts

If you have been unable to make your payments on time, your credit card company might have filed a lawsuit. Although this can be frustrating, it doesn't mean that you are doomed. In most cases, it is possible to resolve your debt without going through the courts. It is possible to obtain legal advice.

Collectors of credit card debt can be aggressive or threatening. They might not even inform you of the total amount that you owe. To help you negotiate with the debt collection agent, you might need to hire an attorney. You have the right and obligation to settle your debt. However, it is important to note that your credit cards agreements contain detailed information that clearly outlines what you are required to do.

Common defenses you could raise in a suit

One of the most common defenses that you can raise in a lawsuit to settle your credit card debt is that the credit card company did not have the right to sue you. This is because the credit card company might have sold your account information on to another agency without a legal basis to sue. This defense can be valuable if the credit card company was wrong about the identity of the person who made the charges.

A credit card company may also be able to claim that they waited too long before filing a lawsuit to resolve your credit card debt. This is called a "statute of limitations" defense, and it can lead to the dismissal of your case. Before you bring a case, consult an attorney.

Which case should you be represented in?

It is possible to feel overwhelmed and scared if you have unpaid bills and are being sued by a credit-card company. There are options. You can represent yourself and tell your story in court. This could impact the outcome.

To collect the debt, a debt collection agency might use strong-arm tactics. They may also not accurately assess the debt. It is important that you understand your rights as a credit-card user before you take on the responsibility of representing yourself. These rights will be outlined in the fine print of credit card agreements. These rights must be understood and protected.

Negotiating a settlement deal with a credit union

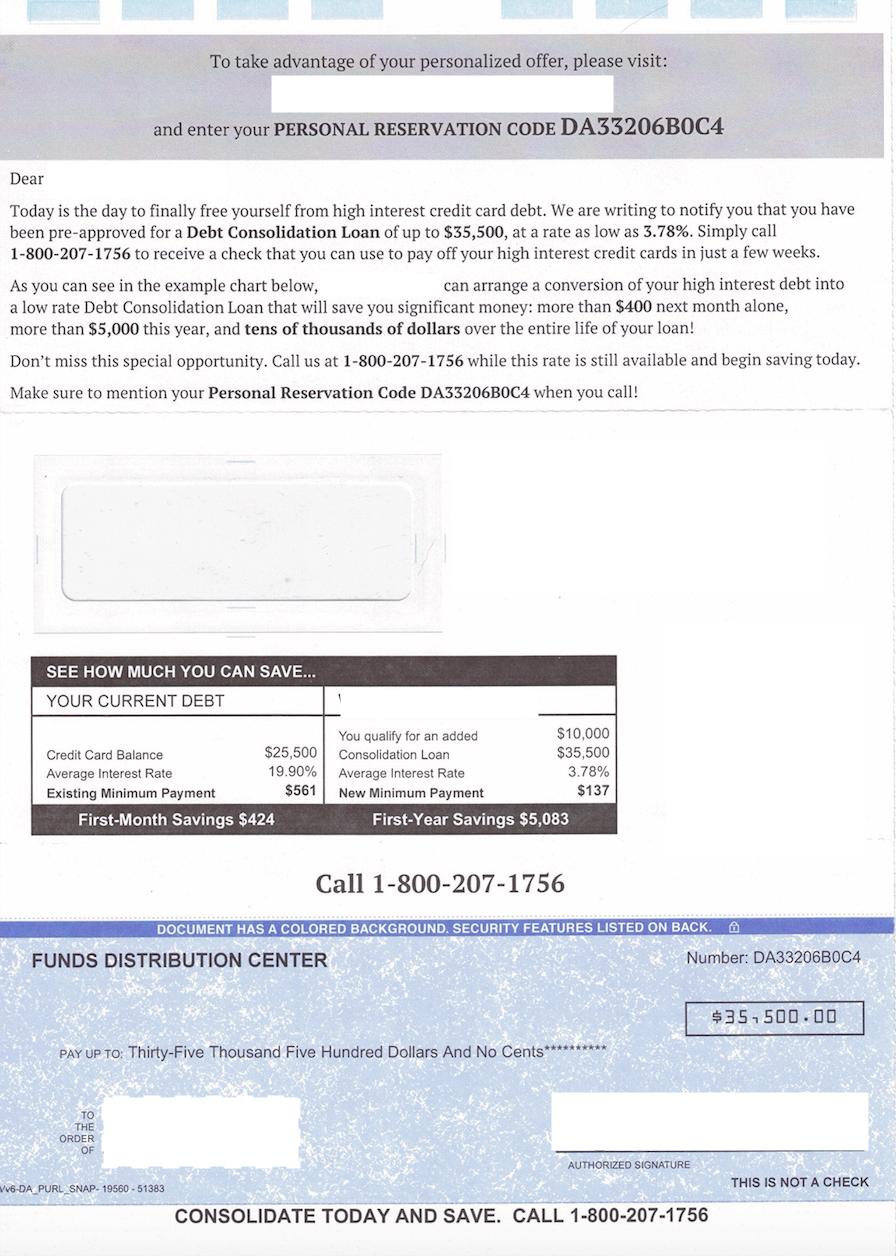

There are several factors that influence whether a credit company is willing to negotiate with you. The first factor is the amount of your balance. If you are already far behind on your payments, the credit card company will not want to negotiate with you. It needs to verify that you are able to afford the settlement amount. The second factor is the interest rate you are currently paying.

First, contact your credit card company. Contact their customer service department to speak with a manager from the debt settlements section. Your situation. You should emphasize that you're in a terrible situation and that it is difficult to afford your monthly bills. Mention that you have multiple accounts. If you do, they are more likely to make a fair offer.

Do your homework before enrolling in a debt settlement program

Debt settlement programs can come with many risks. Make sure you do your research thoroughly before signing up. One of the biggest risks is that your credit score will be affected. If your accounts are in bad standing, the impact will be smaller. Credit scores will be affected more by large debts than those with smaller balances. Be sure to have enough money to make the required payments before you sign up for a debt relief program.

One of the risks of debt settlement programs is that they could leave you deeper in debt than before. Some companies will ask for you to stop making debt payments to your creditors. This will have a negative impact on your credit score. This will also result in late fees and penalties. In the event that you do not make payments, you could be subject to legal action. Your creditors may also file a lawsuit to garnish your wages or place a lien against your house.

FAQ

What side hustles can you make the most money?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types side hustles: active and passive. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. You can also do side hustles like tutoring and dog walking.

The best side hustles make sense for you and fit well within your lifestyle. Consider starting a business in fitness if your passion is working out. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles can be found anywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Maybe you're a writer and want to become a ghostwriter.

You should do extensive research and planning before you begin any side hustle. If the opportunity arises, this will allow you to be prepared to seize it.

Side hustles don't have to be about making money. They can help you build wealth and create freedom.

And with so many ways to earn money today, there's no excuse to start one!

How to make passive income?

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. This requires you to be able connect with people and make sales to them.

You must then figure out how you can convert leads into customers. You must also master customer service to retain satisfied clients.

This is something you may not realize, but every product or service needs a buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

It takes a lot of work to become a millionaire. To become a billionaire, it takes more effort. Why? Why?

And then you have to become a millionaire. Finally, you must become a billionaire. The same is true for becoming billionaire.

So how does someone become a billionaire? It starts with being a millionaire. All you need to do to achieve this is to start making money.

However, before you can earn money, you need to get started. So let's talk about how to get started.

How does rich people make passive income from their wealth?

If you're trying to create money online, there are two ways to go about it. You can create amazing products and services that people love. This is what we call "earning money".

Another way is to create value for others and not spend time creating products. This is called "passive" income.

Let's say that you own an app business. Your job is development apps. Instead of selling apps directly to users you decide to give them away free. This business model is great because it does not depend on paying users. Instead, you rely on advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how internet entrepreneurs who are successful today make their money. They are more focused on providing value than creating stuff.

What side hustles will be the most profitable in 2022

It is best to create value for others in order to make money. You will make money if you do this well.

It may seem strange, but your creations of value have been going on since the day you were born. You sucked your mommy’s breast milk as a baby and she gave life to you. Learning to walk gave you a better life.

You'll continue to make more if you give back to the people around you. In fact, the more value you give, then the more you will get.

Without even realizing it, value creation is a powerful force everyone uses every day. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

Today, Earth is home for nearly 7 million people. This means that every person creates a tremendous amount of value each day. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. Think about that - you would be earning far more than you currently do working full-time.

Let's imagine you wanted to make that number double. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

There are millions of opportunities to create value every single day. This includes selling ideas, products, or information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Ultimately, the real goal is to help others achieve theirs.

Focus on creating value if you want to be successful. You can get my free guide, "How to Create Value and Get Paid" here.

Is there a way to make quick money with a side hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. It's important to have a strong online reputation.

Helping others solve problems is the best way to establish a reputation. You need to think about how you can add value to your community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many ways to make money online.

When you really look, you will notice two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its advantages and disadvantages. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs can be very competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. But it takes longer to establish yourself as an expert in your field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. It will take some trial-and-error. However, the end result is worth it.

What is personal finance?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. It involves understanding where your money goes, knowing what you can afford, and balancing your needs against your wants.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You don't need to worry about monthly rent and utility bills.

You can't only learn how to manage money, it will help you achieve your goals. You'll be happier all around. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

What does personal finance matter to you? Everyone does! Personal finance is a very popular topic today. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. There are only two hours each day that can be used to do all the important things.

Personal finance is something you can master.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money when you're sleeping

You must be able to fall asleep while you're awake if you want to make it big online. This means that you must be able to do more than simply wait for someone click on your link to buy your product. Make money while you're sleeping.

This requires that you create an automated system which makes money automatically without having to do anything. This requires you to master automation.

It would be beneficial to learn how to build software systems that do tasks automatically. So you can concentrate on making money while sleeping. You can even automate your job.

You can find these opportunities by creating a list of daily problems. Consider automating them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. You now need to decide which one would be the most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are hundreds of possibilities.

You can automate anything as long you can think of a solution to a problem. Automation is the key to financial freedom.