Consolidation loans interest rates are based on a borrower's weighted average of all of their other loans. This interest rate is fixed for life. You may be eligible for multiple loans, each with different interest rates depending on how much debt you have. The interest rate for one loan may be higher than the interest rate for another, and vice versa.

Interest rates for debt consolidation loans

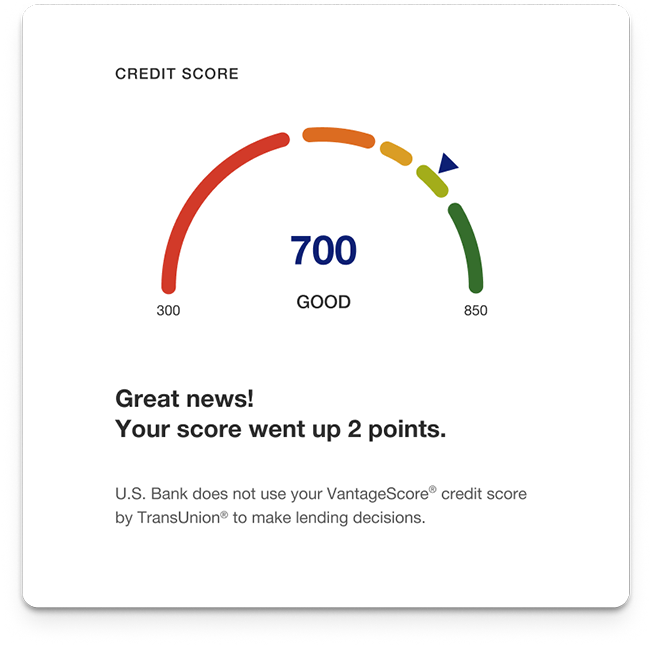

Consolidating your debts with loans can help pay off your credit card debt and save you money on interest. Although you will have to pay interest during the initial period, you can easily cut back over time. This is a great way of improving your credit score.

Credit score requirements

You can still be eligible for a consolidation loan even if your credit is not perfect. Cosigners with good credit are required. The cosigner must meet the lender’s credit requirements and be equally responsible for repaying loan. The cosigner's credit rating will be affected if they fail to repay the loan.

Requirements of a home equity mortgage

Before applying for a home equity loan, it is important to demonstrate your ability to repay the loan. The proof of your income will be required, which may include at least two years of pay, tax returns, and if you are self employed, a profit-and-loss statement. You will have a better chance of getting approved if you show that you can afford the payments.

Credit cards for balance transfer

The balance transfer credit card is a great way of reducing your debt, without having to repay the whole balance. You will not be charged interest for the first few weeks after you transfer your balance. For approval, you must meet the credit requirements of your credit card company and have high credit scores. However, balance transfer credit cards are not free from fees. Some charge prepayment penalties and origination fees. The interest rate can also fluctuate according to market conditions.

Personal

Personal loans are a great option to reduce monthly payments. They typically have lower interest rates that existing debts. They also allow you to spread out repayment over several years. A personal loan is best for those who have good credit.

There are many other options to consolidate debt

Consolidating debt is a great way of reducing interest rates on multiple loans or credit cards. This involves consolidating all of your debt into a single debt. Some banks may give you incentives to pay off your debts. Consolidating debts may also be possible with home equity loans, lines of credit, and other financial instruments.

FAQ

How can a beginner make passive income?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You may have some ideas. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

You can make money online by looking for opportunities that match you skills and interests.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. It will be a long-lasting commitment.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

There are two main ways to go about this. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In either case, once you've set your rates, you'll need to promote them. This can be done via social media, emailing, flyers, or posting them to your list.

These are three ways to improve your chances of success in marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. You never know who could be reading and evaluating your content.

-

Know your subject matter before you speak. No one wants to be a fake expert.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. If someone asks for a recommendation, send it directly to them.

-

Use a good email provider - Gmail and Yahoo Mail are both free and easy to use.

-

Monitor your results: Track how many people open your messages and click links to sign up for your mailing list.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Try different strategies - you may find that some work better than others.

-

Learn and keep growing as a marketer to stay relevant.

What's the best way to make fast money from a side-hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

It is also important to establish yourself as an authority in the niches you choose. It is important to establish a good reputation online as well offline.

Helping people solve problems is the best way build a reputation. Consider how you can bring value to the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

When you really look, you will notice two main side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. It takes more time to become an expert in your field.

In order to succeed at either option, you need to learn how to identify the right clientele. It takes some trial and error. However, the end result is worth it.

How much debt are you allowed to take on?

It is essential to remember that money is not unlimited. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. You should cut back on spending if you feel you have run out of cash.

But how much should you live with? There's no right or wrong number, but it is recommended that you live within 10% of your income. You won't run out of money even after years spent saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. You'll be able to save more money once these are paid off.

It is best to consider whether or not you wish to invest any excess income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. If you save your money, interest will compound over time.

Let's take, for example, $100 per week that you have set aside to save. This would add up over five years to $500. At the end of six years, you'd have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's pretty impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 you would now have $57,000.

This is why it is so important to understand how to properly manage your finances. If you don't, you could end up with much more money that you had planned.

How do rich people make passive income?

There are two ways you can make money online. One way is to produce great products (or services) for which people love and pay. This is called earning money.

Another way is to create value for others and not spend time creating products. This is known as "passive income".

Let's say you own an app company. Your job is developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. That's a great business model because now you don't depend on paying users. Instead, you rely on advertising revenue.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how internet entrepreneurs who are successful today make their money. They give value to others rather than making stuff.

What is the easiest passive source of income?

There are tons of ways to make money online. But most of them require more time and effort than you might have. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here are some examples of 101 affiliate marketing tools, tips & resources.

You might also think about starting a blog to earn passive income. Once again, you'll need to find a topic you enjoy teaching about. You can also make your site monetizable by creating ebooks, courses and videos.

There are many online ways to make money, but the easiest are often the best. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is called content marketing, and it's a great method to drive traffic to your website.

Which side hustles are most lucrative?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles can also be a great way to save money for retirement, have more time flexibility, or increase your earning potential.

There are two types side hustles: active and passive. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. Start a fitness company if you are passionate about working out. You might consider working as a freelance landscaper if you love spending time outdoors.

You can find side hustles anywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Or perhaps you have skills in writing, so why not become a ghostwriter?

Do your research before starting any side-business. You'll be ready to grab the opportunity when it presents itself.

Side hustles can't be just about making a living. They can help you build wealth and create freedom.

And with so many ways to earn money today, there's no excuse to start one!

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to make money even if you are asleep

If you are going to succeed online, you must learn how to sleep while you are awake. You must learn to do more than just wait for people to click on your link and buy your product. Making money at night is essential.

You will need to develop an automated system that generates income without having to touch a single button. Automating is the key to success.

It would help if you became an expert at building software systems that perform tasks automatically. By doing this, you can make money while you sleep. You can even automate the tasks you do.

It is best to keep a running list of the problems you face each day to help you find these opportunities. Next, ask yourself if there are any ways you could automate them.

Once you do that, you will probably find that there are many other ways to make passive income. You now need to decide which one would be the most profitable.

For example, if you are a webmaster, perhaps you could develop a website builder that automates the creation of websites. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds to choose from.

Automation is possible as long your creative ideas solve a problem. Automation is key to financial freedom.