There are several options for you if your credit is not perfect. The first option is to try to get a consolidating loan from your bank. You are more likely to be accepted by your bank and get a better deal than an external lender. Another option is the credit union. These institutions are nonprofit and care about the welfare of their clients.

People with poor credit may be able to get alternatives to debt consolidation loans

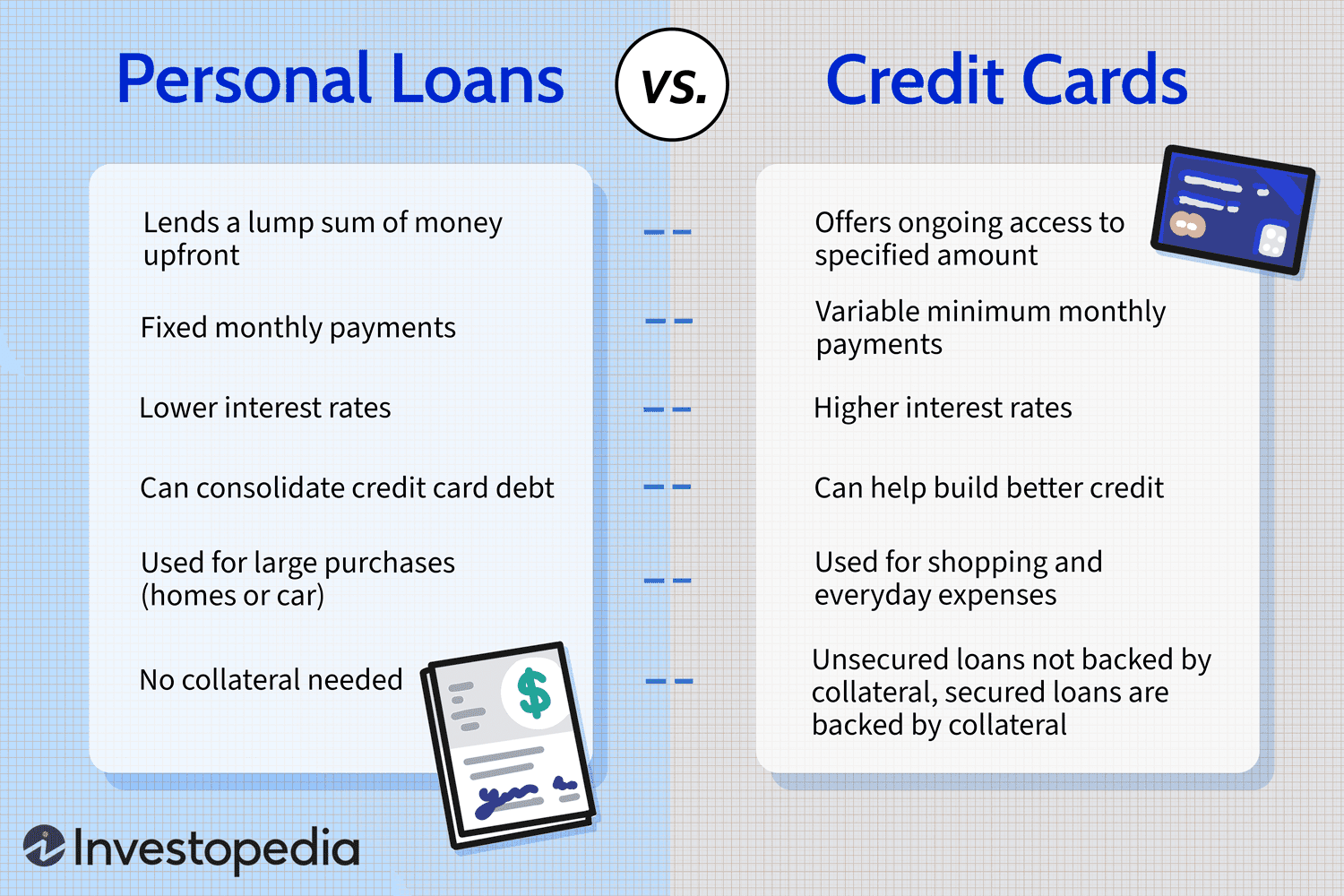

You might consider debt consolidation loans if your credit score is poor and you have difficulty paying your monthly bills. A debt consolidation loan will lower your interest on existing debt. It is usually used to pay off high interest debt. You might have credit card debt that has interest rates between 18 and 25%. However, consolidating these debts into one loan can help you save a lot each month.

People with bad credit may find it more difficult to get debt consolidation loans. In addition to high interest rates, many lenders view people with bad credit as a high risk. It is important to repair your credit before you apply a consolidation loan.

Limitations for consolidation loans for poor credit debt

Although consolidating bad credit debt can be a great way for you to reduce your interest and consolidate your debt, there are some limitations. These loans can be reduced in interest rates and simplified payments. However, they may have a negative impact on your credit score short-term. Hard inquiries can result in a reduction of your credit score by a few point. Therefore, it is important that you consider this when applying to a loan.

Bad credit is one of the major drawbacks of debt consolidation loans. Because bad credit lenders are concerned about their risk, they often raise their interest rates. Some loans may have lower repayment terms than you might expect. Before you agree to take out a loan, make sure you read the terms.

Poor credit is not an obstacle to getting a loan

There are steps you can do to improve your credit score. To increase your credit score you can pay down debts or increase income. Sometimes, you might need to search for additional loan options to improve your credit score.

Bad credit can be caused by many factors such as lack of credit history, financial missteps and high debt-to income ratios. A low credit score will limit your loan options and mean higher interest rates. People with bad credit usually have several negative marks on the credit report, such as late payments. A lower credit score means that lenders are more likely to charge the lender for defaulting on loan payments.

Renegotiating terms of loan

Debt settlement, or renegotiating your debt, is an option to settle your current balance. Some consumers might be able negotiate their debts on their own, even though debt settlement isn't for everyone. First, evaluate your financial situation. Some creditors are reluctant to accept settlements, while others will negotiate. Creditors typically expect a lump payment of 20-50% of the total debt.

FAQ

How do wealthy people earn passive income through investing?

There are two options for making money online. The first is to create great products or services that people love and will pay for. This is known as "earning" money.

The second is to find a method to give value to others while not spending too much time creating products. This is called passive income.

Let's assume you are the CEO of an app company. Your job is developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. It's a great model, as it doesn't depend on users paying. Instead, you can rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how successful internet entrepreneurs today make their money. They focus on providing value to others, rather than making stuff.

What's the best way to make fast money from a side-hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

The best way to build a reputation is to help others solve problems. Consider how you can bring value to the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

However, if you look closely you'll see two major side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs are also highly competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. However, it takes time to become an expert on your subject.

You must learn to identify the right clients in order to be successful at each option. This can take some trial and error. But it will pay off big in the long term.

Why is personal finances important?

A key skill to any success is personal financial management. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why do we delay saving money? Is it not better to use our time or energy on something else?

Yes and no. Yes because most people feel guilty about saving money. Because the more money you earn the greater the opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Controlling your emotions is key to financial success. Negative thoughts will keep you from having positive thoughts.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles that are right for you fit in your daily life. If you love working out, consider starting a fitness business. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles can be found anywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Or perhaps you have skills in writing, so why not become a ghostwriter?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. You'll be ready to grab the opportunity when it presents itself.

Side hustles can't be just about making a living. They can help you build wealth and create freedom.

And with so many ways to earn money today, there's no excuse to start one!

What side hustles are most lucrative in 2022?

You can make money by creating value for someone else. If you do this well the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. When you were little, you took your mommy's breastmilk and it gave you life. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. The truth is that the more you give, you will receive more.

Everyone uses value creation every day, even though they don't know it. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

In fact, there are nearly 7 billion people on Earth right now. Each person creates an incredible amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. That's a huge increase in your earning potential than what you get from working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's assume you discovered 20 ways to make $200 more per month for someone. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

There are millions of opportunities to create value every single day. This includes selling information, products and services.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Helping others achieve theirs is the real goal.

Focus on creating value if you want to be successful. You can get my free guide, "How to Create Value and Get Paid" here.

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You don't need to worry about monthly rent and utility bills.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It will make you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finance anyway? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

Today, people use their smartphones to track budgets, compare prices, and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. There are only two hours each day that can be used to do all the important things.

When you master personal finance, you'll be able to take advantage of that time.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How To Make Money Online

The way people make money online today is very different than 10 years ago. How you invest your funds is changing as well. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods can be more challenging than others. You should be aware of these things if you are serious about making money online.

-

Find out what kind of investor you are. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. Research is essential before you make any commitment to any program. Review, testimonials and past performance records are all good places to start. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Don't jump straight into one large project. Instead, you should start by building something small. This will let you gain experience and help you determine if this type of business suits you. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too soon to start making online money. Even if a long-term employee, there's still time to build up a profitable portfolio of niche websites. You just need a good idea, and some determination. You can take action right now by implementing your ideas.