There are many options if you are in search of a loan but aren’t sure what one to choose. One option is the Upgrade loan. This loan is available to people with good credit or excellent credit. This loan product offers many options with terms and fees.

There are no origination fees or upgrade charges.

Upgrade is an online lender that provides unsecured personal loans. This means that you don't have to put any collateral up as security, but you will have to pay an origination fee. The origination fee is generally between 1.5% and 6% of the loan amount. A late payment fee up to $10 will be added. There are different circumstances that can make you eligible for a loan. The origination fees may be as low as 1.85%. You can check online your eligibility.

When applying for a loan through Upgrade, it is essential to know your financial situation. Although you may not be able to qualify for the most competitive interest rates on the marketplace, you will have more options with Upgrade than other lenders. A high debt to income ratio will make it more difficult for you to qualify for a lower interest rate. However, if you can repay your existing debts, you can qualify for an Upgrade loan.

It allows for flexible repayment plans

Upgrade loans can help you get the money you need quickly. Their online prequalification process doesn't affect your credit score and will help you determine whether they will approve you for the loan. This will require you to give information about your income and personal details. You can choose to apply individually or with a spouse or partner.

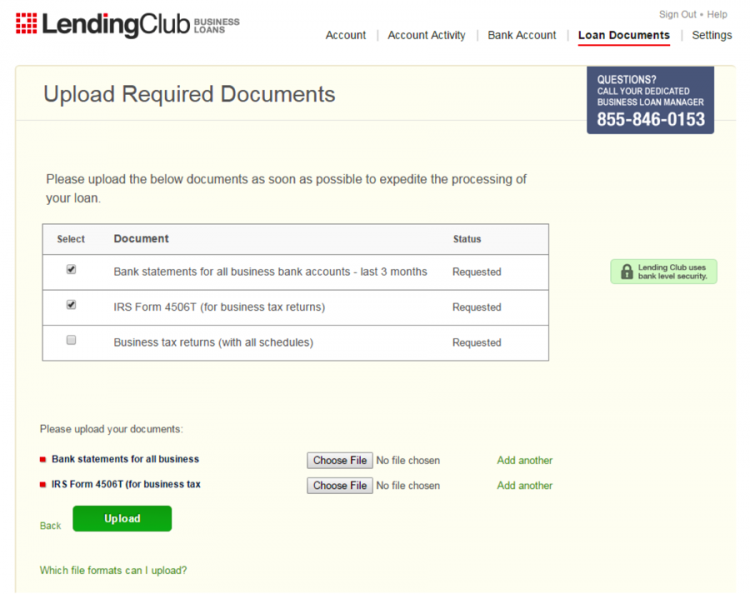

It's quick and easy to apply. To receive a loan from Upgrade, you'll have to submit a complete application, including bank account details for direct deposit. You should also compare rates, as even a difference of one to two percentage points can help you save hundreds of dollars in interest. Credible makes it easy to compare rates.

It has a high average rate of return

Some borrowers might be concerned by the high APR for an Upgrade loan. The lender will consider your monthly income, debt-to-income ratio and monthly expenses. Customers who have difficulty paying their monthly payments can also be assisted by the company through a hardship program. This program can include a reduced monthly payment or loan modification.

Upgrade charges origination fees, in addition to the very high APR. These fees range from 2.9% to 8% of the loan's balance, which means that the loan will cost you more than you thought. The amount of the loan will determine how much late payment fees you have to pay. If you're worried about the cost of borrowing money, use an online calculator to estimate your payment.

The minimum credit score is not required

A prospective borrower must fill out the online application form to be eligible for an upgrade loan. While submitting the online application will not impact a borrower’s credit score or credit rating, it will be taken into consideration more than just the borrower’s debt-to income ratio. The company will also take into account a borrower’s monthly expenses. The circumstances of a borrower could lead to a reduction in monthly payments or even a modification to the loan.

Before you apply for an Upgrade loan, make sure to read the terms. The borrower must be a U.S. citizen, permanent resident, or over the age of 18 in their state. They also need to have a verified bank account and a valid email address. The company will charge an origination fee of 1.85% to 8.00% of the total loan amount. The loan term is minimum two years. A 1-year loan has an interest rate of 9.9%.

It is a good choice for borrowers with less than stellar credit

An Upgrade loan is a loan that you might consider if your credit score isn't great. The company provides online prequalification so that you can quickly get an estimate of the amount you can borrow. During this process, you'll need to provide information about your income, purpose for the loan, and bank account information. You can apply both individually and jointly.

A typical personal loan for Upgrade can take up to seven years to pay back. The loan will have a comparatively higher APR than a typical personal loan. It will be a good choice for borrowers with poor credit scores as it comes with lower origination fee.

FAQ

How can a beginner earn passive income?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You might even already have some ideas. If you do, great! You're great!

Finding a job that matches your interests and skills is the best way to make money online.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever your focus, choose something you are passionate about. If you enjoy it, you will stick with the decision for the long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main approaches to this. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In both cases, once you have set your rates you need to make them known. This includes sharing your rates on social media and emailing your subscribers, as well as posting flyers and other promotional materials.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

Market like a professional: Always act professional when you do anything in marketing. You never know who may be reading your content.

-

Know what you're talking about - make sure you know everything about your topic before you talk about it. False experts are unattractive.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. Send a recommendation directly to anyone who asks.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Learn new things - Keep learning to be a marketer.

What side hustles can you make the most money?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles are important as they can provide additional income for bills or fun activities.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. You can also do side hustles like tutoring and dog walking.

The best side hustles make sense for you and fit well within your lifestyle. A fitness business is a great option if you enjoy working out. Consider becoming a freelance landscaper, if you like spending time outdoors.

You can find side hustles anywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Maybe you're a writer and want to become a ghostwriter.

You should do extensive research and planning before you begin any side hustle. You'll be ready to grab the opportunity when it presents itself.

Remember, side hustles aren't just about making money. They can help you build wealth and create freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

What is the difference between passive income and active income?

Passive income is when you earn money without doing any work. Active income requires hardwork and effort.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. So they choose to invest time and energy into earning passive income.

Problem is, passive income won't last forever. If you hold off too long in generating passive income, you may run out of cash.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

Is there a way to make quick money with a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. That means building a reputation online as well as offline.

Helping others solve problems is the best way to establish a reputation. You need to think about how you can add value to your community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many ways to make money online.

But when you look closely, you can see two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has its pros and cons. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. You will also find fierce competition for these gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it can take longer to be recognized as an expert in your area.

In order to succeed at either option, you need to learn how to identify the right clientele. It takes some trial and error. However, the end result is worth it.

How much debt is considered excessive?

It is essential to remember that money is not unlimited. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. Spend less if you're running low on cash.

But how much do you consider too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. You won't run out of money even after years spent saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 If you earn $50,000, you should not spend more than $5,000 per calendar month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans and credit card bills. Once those are paid off, you'll have extra money left over to save.

You should consider where you plan to put your excess income. You may lose your money if the stock markets fall. If you save your money, interest will compound over time.

Consider, for example: $100 per week is a savings goal. Over five years, that would add up to $500. Over six years, that would amount to $1,000. You'd have almost $3,000 in savings by the end of eight years. In ten years you would have $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. Now that's quite impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

You need to be able to manage your finances well. A poor financial management system can lead to you spending more than you intended.

What side hustles are most lucrative in 2022?

The best way today to make money is to create value in the lives of others. If you do this well, the money will follow.

You may not realize it now, but you've been creating value since day 1. When you were a baby, you sucked your mommy's breast milk and she gave you life. Learning to walk gave you a better life.

As long as you continue to give value to those around you, you'll keep making more. Actually, the more that you give, the greater the rewards.

Value creation is an important force that every person uses every day without knowing it. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

In fact, there are nearly 7 billion people on Earth right now. Each person is creating an amazing amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

It means that if there were ten ways to add $100 to the lives of someone every week, you'd make $700,000.000 extra per year. That's a huge increase in your earning potential than what you get from working full-time.

Now, let's say you wanted to double that number. Let's say you found 20 ways to add $200 to someone's life per month. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every day there are millions of opportunities for creating value. This includes selling products, services, ideas, and information.

Although our focus is often on income streams and careers, these are not the only things that matter. Helping others to achieve their goals is the ultimate goal.

You can get ahead if you focus on creating value. You can start by using my free guide: How To Create Value And Get Paid For It.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to Make Money Even While You Sleep

If you are going to succeed online, you must learn how to sleep while you are awake. You must learn to do more than just wait for people to click on your link and buy your product. Making money at night is essential.

This requires you to create an automated system that makes money without you having to lift a finger. Automation is a skill that must be learned.

It would be helpful if you could become an expert at creating software systems that automatically perform tasks. This will allow you to focus on your business while you sleep. You can automate your job.

The best way to find these opportunities is to put together a list of problems you solve daily. Then ask yourself if there is any way that you could automate them.

Once that's done, you'll likely discover that you already have many potential passive income sources. Now, it's time to find the most lucrative.

You could, for example, create a website builder that automates creating websites if you are webmaster. Perhaps you are a graphic artist and could use templates to automate the production logos.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are hundreds of possibilities.

You can automate anything as long you can think of a solution to a problem. Automation is the key for financial freedom.