Consolidating multiple student loans into one loan may be a good option. Federal Direct Student Loan Program offers consolidation loans. Consolidation loans allow for borrowers to make one monthly payment and have a longer loan term. You can also consolidate your debt to get a loan that offers better terms.

Repayment plan

There are many ways to consolidate student loans and get them paid off. One way is to apply for a consolidation loan. You have many repayment options with these loans, including income-driven and graduated payment plans. These options can help make your payments more affordable, and make it easier for you to repay your debt.

The repayment plan will depend on how much you want to borrow, and the length of time you can afford to pay back the money. A standard repayment plan typically takes ten years. It is the cheapest and most cost-effective option. But, you may pay more monthly than with other repayment plans.

Interest rate

Consolidating student loan debts will lead to a lower interest rate. This is the weighted-average of all loans. This interest rate will be fixed for the life of the loan. It is important to consider this when you are determining if a consolidation loan is right for you. Consolidation loans can have fixed or variable interest rates.

Consolidating your loans is a great option to lower your monthly payment. A single monthly bill is all that you will have to deal with and there's no chance of missing a repayment, which could negatively impact your credit rating. The negative effects that default can have on your credit score for seven years. Therefore, it is crucial to avoid it as often as possible. Paying your student loans using automatic debits can help you avoid late payments and maintain stable credit scores. To avoid missing payments and penalties, make sure you make your monthly payments on time.

Cost

Consolidation companies are trying to help you get business as student loan costs rise. Lenders are bombarding you with e-mail and letters to urge you to consolidate before interest rates increase almost two percentage point to 7.14 percent on August 1. Lenders are offering hundreds of dollars in student checks to students who make their first payment.

Consolidating student loans can simplify your monthly payments and help you save hundreds of dollars. CNBC Select's analysis shows that an average student loan borrower can save between $4,000- $7000 over the course of their student loans.

Direct consolidation loan

Direct consolidation loan for student loan is a loan that consolidates multiple student loans into one. This allows for lower monthly payments and a longer term. Using this type of loan can be very beneficial if you are struggling to pay multiple debts, but you need to be careful and comparison shop carefully. You don't wish to end up with more debt than your budget can handle.

Direct Consolidation Loans are a way to consolidate federal student loans into one affordable monthly payment. This loan lets you choose the servicer you wish to work with, and you only have one monthly payment. The process of applying for a Direct Consolidation Loan will take from four to six weeks.

FAQ

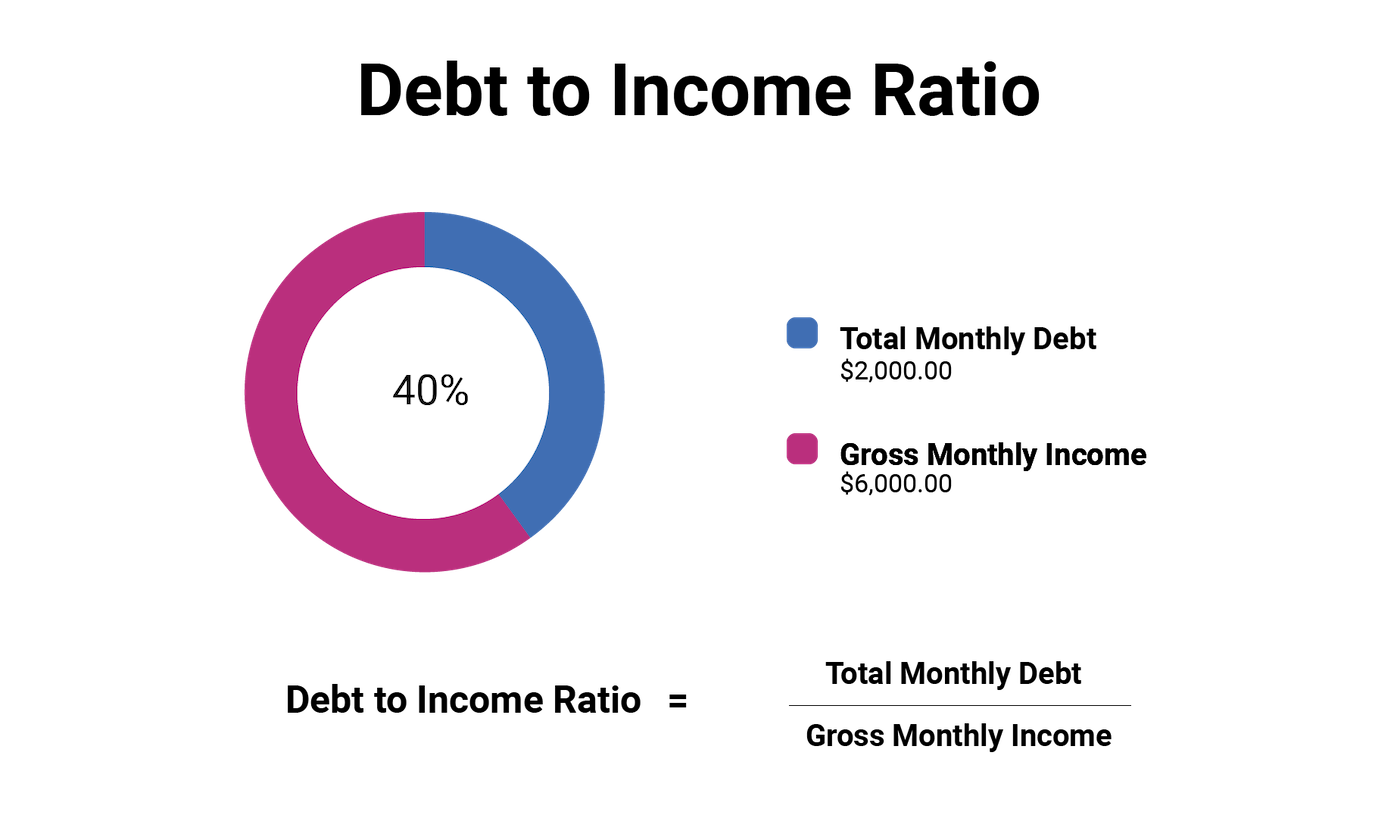

What is the limit of debt?

It is essential to remember that money is not unlimited. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. Spend less if you're running low on cash.

But how much is too much? There is no universal number. However, the rule of thumb is that you should live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. You should not spend more than $2,000 a month if you have $20,000 in annual income. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It is important to get rid of debts as soon as possible. This applies to student loans, credit card bills, and car payments. Once these are paid off, you'll still have some money left to save.

You should also consider whether you would like to invest any surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if the money is put into savings accounts, it will compound over time.

For example, let's say you set aside $100 weekly for savings. This would add up over five years to $500. In six years you'd have $1000 saved. In eight years, you'd have nearly $3,000 in the bank. In ten years you would have $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. It's impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000, your net worth would be more than $57,000.

You need to be able to manage your finances well. Otherwise, you might wind up with far more money than you planned.

How do rich people make passive income?

There are two ways you can make money online. Another way is to make great products (or service) that people love. This is called "earning” money.

You can also find ways to add value to others, without having to spend your time creating products. This is called "passive" income.

Let's say you own an app company. Your job involves developing apps. But instead of selling them directly to users, you decide to give them away for free. This business model is great because it does not depend on paying users. Instead, you rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how successful internet entrepreneurs today make their money. They focus on providing value to others, rather than making stuff.

What is the difference in passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires work and effort.

Your active income comes from creating value for someone else. When you earn money because you provide a service or product that someone wants. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

Passive income isn't sustainable forever. If you hold off too long in generating passive income, you may run out of cash.

Also, you could burn out if passive income is not generated in a timely manner. It is best to get started right away. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types of passive income streams:

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Which passive income is easiest?

There are many options for making money online. However, most of these require more effort and time than you might think. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here's a list with 101 tips and resources for affiliate marketing.

You could also consider starting a blog as another form of passive income. Once again, you'll need to find a topic you enjoy teaching about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

While there are many options for making money online, the most effective ones are the easiest. You can make money online by building websites and blogs that offer useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is called content marketing, and it's a great method to drive traffic to your website.

Is there a way to make quick money with a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. It's important to have a strong online reputation.

Helping other people solve their problems is the best way for a person to earn a good reputation. So you need to ask yourself how you can contribute value to the community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many online ways to make money, but they are often very competitive.

If you are careful, there are two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each method has its own pros and con. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. These gigs can be very competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. But, it takes longer to become an expert in your chosen field.

In order to succeed at either option, you need to learn how to identify the right clientele. This requires a little bit of trial and error. However, the end result is worth it.

Why is personal financing important?

For anyone to be successful in life, financial management is essential. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why do we delay saving money? Is it not better to use our time or energy on something else?

Yes and no. Yes because most people feel guilty about saving money. Because the more money you earn the greater the opportunities to invest.

Focusing on the big picture will help you justify spending your money.

It is important to learn how to control your emotions if you want to become financially successful. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This could be because you don't know how your finances should be managed.

These skills will prepare you for the next step: budgeting.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to Make Money Even While You Sleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means more than waiting for someone to click on the link or buy your product. Make money while you're sleeping.

You will need to develop an automated system that generates income without having to touch a single button. To do that, you must master the art of automation.

It would be beneficial to learn how to build software systems that do tasks automatically. By doing this, you can make money while you sleep. You can even automate your job.

The best way to find these opportunities is to put together a list of problems you solve daily. Next, ask yourself if there are any ways you could automate them.

Once you do that, you will probably find that there are many other ways to make passive income. Now you need to choose which is most profitable.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds to choose from.

Automating a problem can be done as long as you have a creative solution. Automating is key to financial freedom.