It is crucial to know your rights when you are sued in relation to credit card debt. You may be harassed by the debt collection agency using strong-arm tactics. It might also mislead customers about how much they owe. In this case, you'll want to hire a lawyer to protect your rights. You have certain rights as set out in your credit card agreement.

If you are sued for credit card debt

Your credit card company may have filed a lawsuit if you are unable to pay your bills on time. This can be a difficult situation to be in, but it doesn't have to be hopeless. Many cases can be settled without ever going to court. You can also seek the assistance of a lawyer.

Collectors of credit card debt can be aggressive or threatening. They might not even inform you of the total amount that you owe. To negotiate with debt collectors, you may need to engage a lawyer. You have the right to settle your debt, and it's important to remember that your credit card agreements contain fine print that spells out what you need to do.

Common defenses in a lawsuit

One of the most common defenses that you can raise in a lawsuit to settle your credit card debt is that the credit card company did not have the right to sue you. The credit card company could have sold your account information and thus, has no legal basis for suing you. This defense is valuable if the creditor company was incorrect about the identity of the person making the charges.

Another common defense to use in a lawsuit to settle credit card debt is the claim that the creditor company waited too long for the lawsuit to be filed. This defense is called the "statutes of limitations" and can result in your case getting dismissed. Before you bring a case, consult an attorney.

What is the best way to represent yourself during a lawsuit

You may feel scared and overwhelmed if you have unpaid credit card debt. There are options. If you prefer to represent yourself in court, you can tell your side of the story. This could affect the outcome of your lawsuit.

To collect the debt, a debt collection agency might use strong-arm tactics. You may also find that their assessment is not accurate. You should be aware of your rights as credit card users if you decide to represent yourself. These rights are outlined in the fine print of your credit card agreement. These rights are important and should be protected.

Negotiating a settlement with a credit card company

A number of factors can affect a credit card company’s willingness to settle with you. The first factor is the amount of your balance. The credit card company is unlikely to negotiate with someone who is already behind in payments. It wants to see proof of your ability to pay the settlement amount. The second factor is the interest you are currently paying.

First, call the credit card company. To speak to someone in the debt settlements team, call their customer service number. Tell them about your situation. Be clear that your situation is dire and that money is not available to pay your monthly bill. Mention if you have multiple accounts. They will be more likely make you a fair deal if they know.

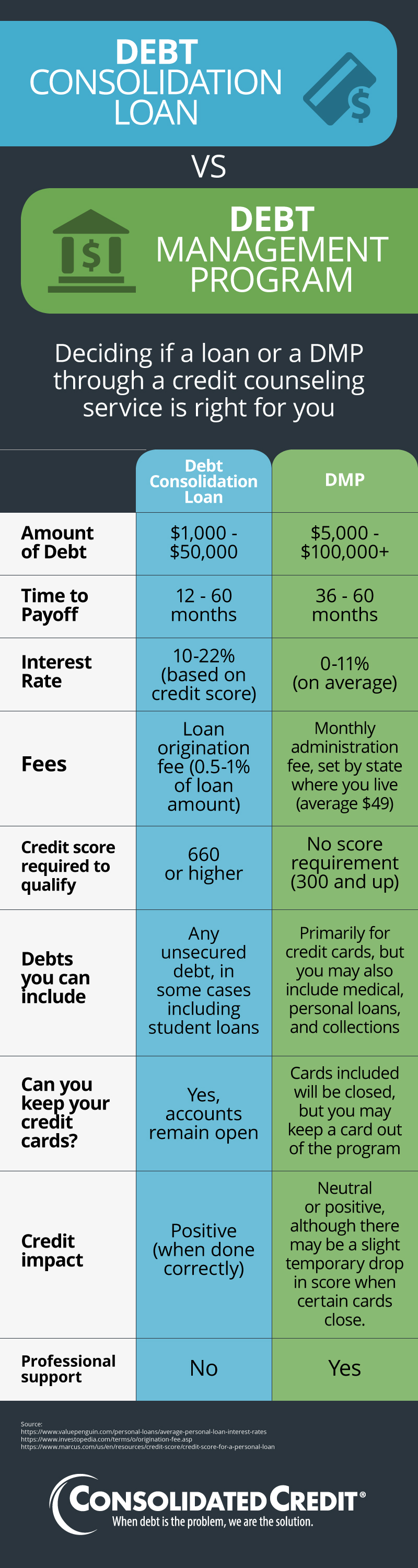

Do your homework before enrolling in a debt settlement program

Debt settlement programs have many risks and you should research them thoroughly before enrolling. The biggest risk is that your credit score could be negatively affected. The impact of your accounts in default will be minimal, while those in good standing will have a greater impact. Credit scores will be affected more by large debts than those with smaller balances. So, before enrolling in a debt settlement program, make sure that you can afford the payments required.

One of the dangers of debt settlement is that you could end up deeper in debt than ever before. Some companies may ask you to stop paying your creditors. This will adversely affect your credit score. Late fees and penalties could also be a result. If you don't make your payments on time, you may be sued. Your creditors can also garnish your wages and place a lien on you home if you fail to make payments.

FAQ

How can rich people earn passive income?

If you're trying to create money online, there are two ways to go about it. Another way is to make great products (or service) that people love. This is called earning money.

The second is to find a method to give value to others while not spending too much time creating products. This is called "passive" income.

Let's say you own an app company. Your job is development apps. Instead of selling apps directly to users you decide to give them away free. It's a great model, as it doesn't depend on users paying. Instead, you can rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how internet entrepreneurs who are successful today make their money. They give value to others rather than making stuff.

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You don't need to worry about monthly rent and utility bills.

And learning how to manage your money doesn't just help you get ahead. It will make you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

So who cares about personal finance? Everyone does! Personal finance is a very popular topic today. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People use their smartphones today to manage their finances, compare prices and build wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. Only two hours are left each day to do the rest of what is important.

Personal finance is something you can master.

Why is personal finance important?

Anyone who is serious about financial success must be able to manage their finances. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

Why then do we keep putting off saving money. What is the best thing to do with our time and energy?

Yes and no. Yes because most people feel guilty about saving money. It's not true, as more money means more opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

You must learn to control your emotions in order to be financially successful. Negative thoughts will keep you from having positive thoughts.

You may also have unrealistic expectations about how much money you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

These skills will prepare you for the next step: budgeting.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What side hustles are most lucrative in 2022?

The best way today to make money is to create value in the lives of others. If you do this well the money will follow.

While you might not know it, your contribution to the world has been there since day one. When you were a baby, you sucked your mommy's breast milk and she gave you life. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. In fact, the more you give, the more you'll receive.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

Today, Earth is home for nearly 7 million people. That means that each person is creating a staggering amount of value daily. Even if you created $1 worth of value an hour, that's $7 million a year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. You would earn far more than you are currently earning working full-time.

Let's say that you wanted double that amount. Let's assume you discovered 20 ways to make $200 more per month for someone. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

There are millions of opportunities to create value every single day. This includes selling information, products and services.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Ultimately, the real goal is to help others achieve theirs.

You can get ahead if you focus on creating value. My free guide, How To Create Value and Get Paid For It, will help you get started.

What's the difference between passive income vs active income?

Passive income can be defined as a way to make passive income without any work. Active income is earned through hard work and effort.

When you make value for others, that is called active income. When you earn money because you provide a service or product that someone wants. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because it allows you to focus on more important things while still making money. Most people don't want to work for themselves. They choose to make passive income and invest their time and energy.

The problem is that passive income doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

Also, you could burn out if passive income is not generated in a timely manner. It is best to get started right away. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types of passive income streams:

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

How can a beginner make passive money?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You might even have some ideas. If you do, great! However, if not, think about what you can do to add value to the world and how you can put those thoughts into action.

Find a job that suits your skills and interests to make money online.

If you are passionate about creating apps and websites, you can find many opportunities to generate revenue while you're sleeping.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. You'll be more likely to stick with it over the long-term.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

You have two options. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In each case, once your rates have been set, you will need to promote them. This means sharing them on social media, emailing your list, posting flyers, etc.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

e professional - always act like a professional when doing anything related to marketing. You never know who will review your content.

-

Know what you're talking about - make sure you know everything about your topic before you talk about it. After all, no one likes a fake expert.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. If someone asks for a recommendation, send it directly to them.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Ask your family and friends for feedback.

-

You can try different tactics to find the best one.

-

Learn and keep growing as a marketer to stay relevant.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to make money online

Today's methods of making money online are very different from those used ten years ago. How you invest your funds is changing as well. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are easier than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out what kind investor you are. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. Before you make a commitment to any program, do your research. Review, testimonials and past performance records are all good places to start. You don’t want to spend your time and energy on something that doesn’t work.

-

Start small. Do not rush to tackle a huge project. Instead, begin by building something basic first. This will allow you to learn the ropes and help you decide if this business is for you. Once you feel confident enough to take on larger projects.

-

Get started now! It's never too soon to start making online money. Even if your job has been full-time for many years, there is still plenty of time to create a portfolio of niche websites that are profitable. All that's required is a good idea as well as some commitment. Now is the time to get started!