Debt consolidation has many advantages over bankruptcy. Even though it is more costly, debt consolidation may be a better option for you if you need to make major purchases. In addition, bankruptcy can damage your credit score. Consolidating debt is a good option if you want to purchase a house or a vehicle.

Chapter 7 bankruptcy

Chapter 7 bankruptcy could be the best option for those with overwhelming debt. Bankruptcy doesn't erase all of your debt. But it can reduce your monthly repayments and eliminate interest. Chapter 7 bankruptcy will require the sale of your non-exempt possessions like your car and furniture. It's important to consider all options before you choose bankruptcy.

Chapter 7 bankruptcy means that your assets are sold to pay your creditors. Some cases allow you to retain some of your assets, and avoid having to repay the entire amount. You may be a better candidate for a debt management program if you have a steady job and a regular income. Chapter 7 bankruptcy is an option for those who don't have enough income to pay down their debts.

Consolidate your debt

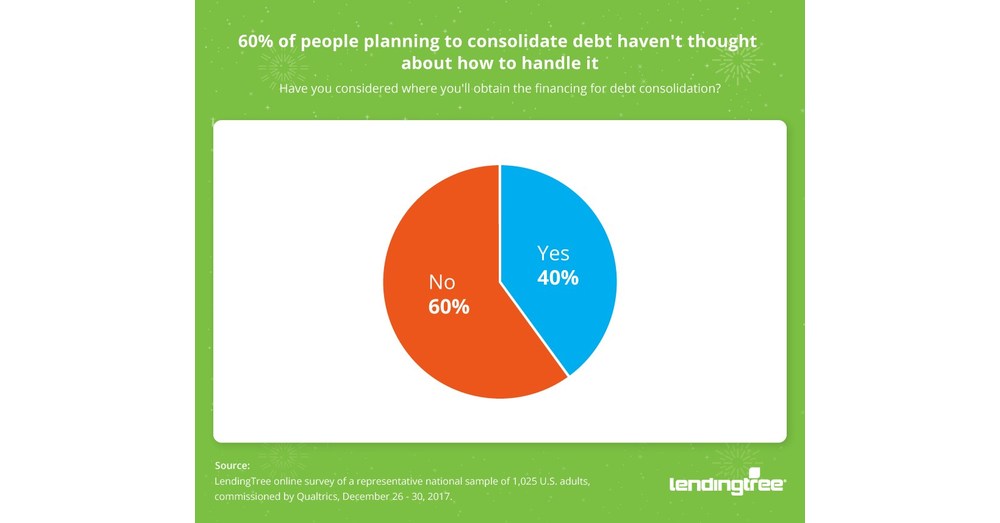

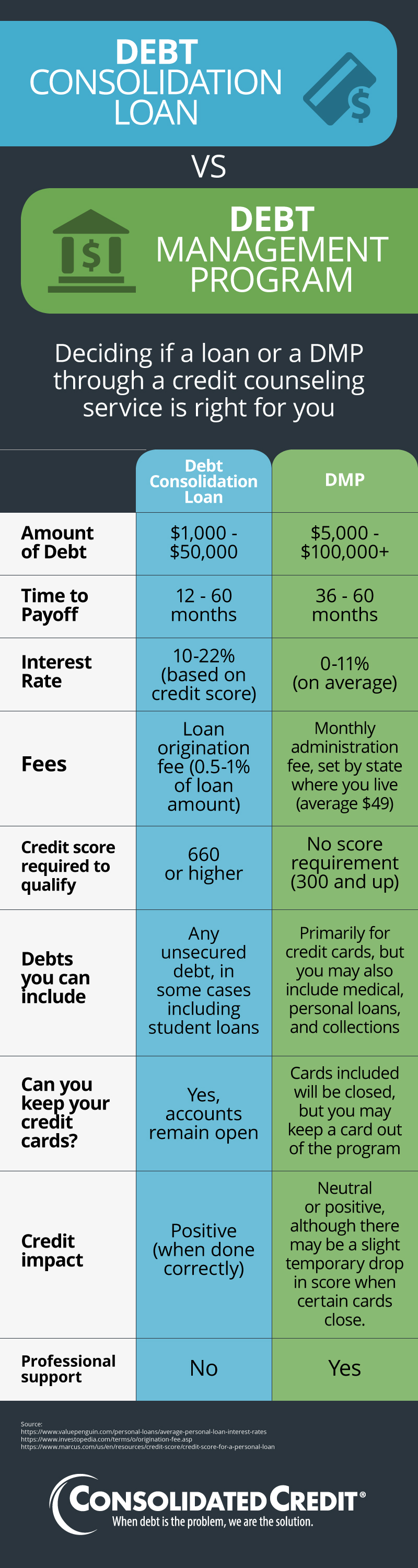

It depends on your financial situation whether you want to consolidate debt or go bankrupt. While the former has lower interest rates, the latter can help protect your credit. Both are viable options, but they may not be for everyone. Before you decide which is best for you, consider the pros and cons of each. While consolidation of debt is generally better for people with poor credit scores, it's important to weigh the pros and cons before making a final decision.

Your credit score can be affected by bankruptcy. Additionally, the costs of filing bankruptcy can be high. If you are able to make your monthly payments, but have overspent on credit cards, bankruptcy may be an option.

InCharge credit counseling

InCharge offers many credit counseling services such as debt management programs and consolidation. The non-profit organization is also a major provider of bankruptcy education, pre-file credit counselling, and other services. The company offers educational resources and webinars for anyone considering filing bankruptcy. The company also provides a mobile application that allows clients to access their accounts from anywhere. Clients can access their account status from anywhere, add new creditors and modify payment dates.

While bankruptcy is a drastic option, it can be an effective way to overcome debt and get back on your feet. It can also lead to permanent damage to credit scores. Bankruptcy doesn't erase all debts. People often choose to seek credit counseling before declaring bankruptcy.

Impact of bankruptcy upon credit score

The impact of bankruptcy on your credit score can vary based on several factors. Two of the most important factors in this analysis are the amount of debt you have eliminated and the ratio of available credit to debt. There are steps that you can take to increase your credit score, even though you will have to start all over again after you file for bankruptcy.

The first step in understanding the impact of bankruptcy is to understand your credit score. Your score can be affected by bankruptcy by as much as 130 to 200 points. This is a substantial drop. However, the effect will diminish over time. After you file for bankruptcy, you should focus on building new credit and developing new financial habits. Credit card companies often consider your credit rating when deciding whether you should be granted credit.

FAQ

How do wealthy people earn passive income through investing?

There are two options for making money online. One way is to produce great products (or services) for which people love and pay. This is called earning money.

You can also find ways to add value to others, without having to spend your time creating products. This is "passive" income.

Let's say you own an app company. Your job is to create apps. You decide to give away the apps instead of making them available to users. Because you don't rely on paying customers, this is a great business model. Instead, you can rely on advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how internet entrepreneurs who are successful today make their money. Instead of making money, they are focused on providing value to others.

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

Understanding their needs and wants is key. It is important to learn how to communicate with people and to sell to them.

Next, you need to know how to convert leads to sales. Finally, you must master customer service so you can retain happy clients.

You may not realize this, but every product or service has a buyer. Knowing who your buyer is will allow you to design your entire company around them.

You have to put in a lot of effort to become millionaire. A billionaire requires even more work. Why? Because to become a millionaire, you first have to become a thousandaire.

And then you have to become a millionaire. Finally, you can become a multi-billionaire. The same applies to becoming a millionaire.

So how does someone become a billionaire? It starts by being a millionaire. All you have to do in order achieve this is to make money.

You must first get started before you can make money. Let's now talk about how you can get started.

What is personal finance?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. It involves understanding where your money goes, knowing what you can afford, and balancing your needs against your wants.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You can forget about worrying about rent, utilities, or any other monthly bills.

You can't only learn how to manage money, it will help you achieve your goals. It makes you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

So, who cares about personal financial matters? Everyone does! The most searched topic on the Internet is personal finance. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

People now use smartphones to track their money, compare prices and create wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. There are only two hours each day that can be used to do all the important things.

If you are able to master personal finance, you will be able make the most of it.

How can a novice earn passive income as a contractor?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You might have some ideas. If you do, great! You're great!

Find a job that suits your skills and interests to make money online.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. This will ensure that you stick with it for the long-term.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

This can be done in two ways. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In each case, once your rates have been set, you will need to promote them. You can share them on social media, email your list, post flyers, and so forth.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

e professional - always act like a professional when doing anything related to marketing. You never know who could be reading and evaluating your content.

-

Know your subject matter before you speak. A fake expert is not a good idea.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. If someone asks for a recommendation, send it directly to them.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Learn and keep growing as a marketer to stay relevant.

What is the best passive income source?

There are tons of ways to make money online. Some of these take more time and effort that you might realize. How can you make it easy for yourself to make extra money?

You need to find what you love. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You might also think about starting a blog to earn passive income. Again, you will need to find a topic which you love teaching. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

While there are many methods to make money online there are some that are more effective than others. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is known as content marketing and it's a great way to drive traffic back to your site.

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income requires effort and hard work.

When you make value for others, that is called active income. When you earn money because you provide a service or product that someone wants. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great because it allows you to focus on more important things while still making money. Most people don't want to work for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem with passive income is that it doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to Make Money online

Making money online is very different today from 10 years ago. The way you invest your money is also changing. There are many ways to earn passive income, but most require a lot of upfront investment. Some methods are easier than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out what kind investor you are. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. You must research any program before you decide to commit. Review, testimonials and past performance records are all good places to start. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Do not just jump in to one huge project. Instead, begin by building something basic first. This will let you gain experience and help you determine if this type of business suits you. Once you feel confident enough to take on larger projects.

-

Get started now! It is never too late to make money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need is a good idea and some dedication. Take action now!