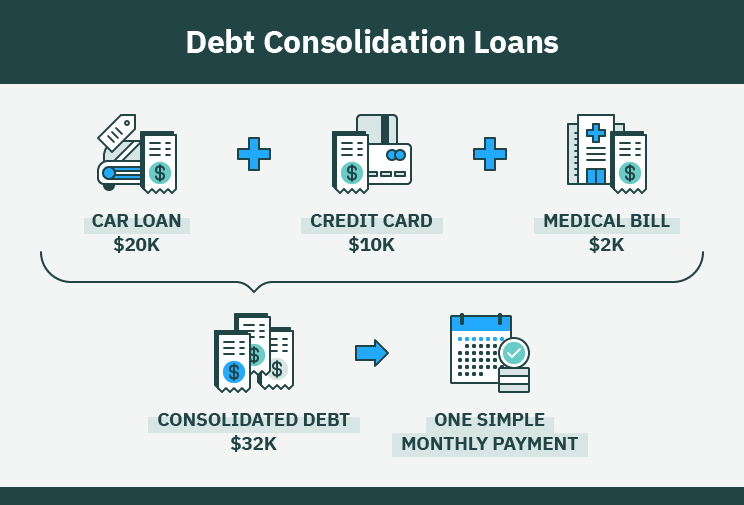

There are a lot of benefits to debt consolidation, and it will allow you to pay off all your existing bills in one easy monthly payment. It is possible to avoid dealing with debt collectors, and you can manage multiple due dates. In addition, if you are looking for the best ways to consolidate debt, read on for more information.

Personal loans at low interest

An unsecured personal loan is one of the best ways you can consolidate debt. These loans are easy to qualify for and provide funding quickly. A home equity loan is a good option for those with bad credit. You may find that home equity loans are more affordable than other types of financing.

The balance transfer credit cards are another great option to consolidate debt. These cards offer 0% APR from 12 to 21 monthly, and then they revert to regular rates. A home equity loan is another popular option. This allows you to use the funds for virtually any purpose.

Balance transfer credit cards

One of the best ways to consolidate debt is to transfer your balances from your old cards to new ones. This is often called credit card refinancing. For a promotional period of twelve to 18 months, balance transfer credit cards can often offer zero interest rates. However, you must have excellent credit to qualify for this type of card. They often have no annual fees. Before you transfer your balance, make sure to calculate how much interest you'll save.

Debt consolidation's main purpose is to reduce interest rates, which will allow you to pay off principal. You can get a credit card with 0% APR for a great deal. The principal will be eliminated and your payments will be directly repaid.

Home equity loans

One of the best ways to consolidate debt is to take out a home equity loan. The downside to these loans is that they can increase foreclosure risk. The closing costs associated with home equity loans are typically between 2% and 5% of the loan amount. However, lenders may cover these costs.

Home equity loans also have lower interest rates. This can help you save thousands of dollars each year on interest. Furthermore, a home equity loan may also come with a shorter repayment period, which can help you pay off your debt faster.

401(k) loans

One of the best ways to consolidate debt is through a 401(k) loan. You can apply to borrow money with your 401k, and then pay it back over five years. The loan has low interest rates and can be paid off more quickly than you would otherwise be able to.

Your employer and your type of plan will determine the amount of loan you are eligible for. Before applying for a loan, you should consult your company's human resources department. You may not be eligible to borrow more than $10,000 depending on your plan.

FAQ

Why is personal finance important?

Anyone who is serious about financial success must be able to manage their finances. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why should we wait to save money? Is there something better to invest our time and effort on?

Yes and no. Yes, because most people feel guilty when they save money. Because the more money you earn the greater the opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

Controlling your emotions is key to financial success. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

It is possible to have unrealistic expectations of how much you will accumulate. This is because your financial management skills are not up to par.

After mastering these skills, it's time to learn how to budget.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

Which side hustles have the highest potential to be profitable?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types: active and passive side hustles. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles are smart and can fit into your life. Consider starting a business in fitness if your passion is working out. If you love to spend time outdoors, consider becoming an independent landscaper.

There are many side hustles that you can do. Side hustles can be found anywhere.

Why not start your own graphic design company? Or perhaps you have skills in writing, so why not become a ghostwriter?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles can't be just about making a living. They can help you build wealth and create freedom.

There are so many ways to make money these days, it's hard to not start one.

What is the fastest way you can make money in a side job?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You also have to find a way to position yourself as an authority in whatever niche you choose to fill. It means building a name online and offline.

Helping others solve problems is the best way to establish a reputation. Consider how you can bring value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

However, if you look closely you'll see two major side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each method has its own pros and con. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. You will also find fierce competition for these gigs.

Consulting allows you to grow your business without worrying about shipping products or providing services. It takes more time to become an expert in your field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. This takes some trial and errors. However, the end result is worth it.

How to build a passive stream of income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

It means listening to their needs and desires. You need to know how to connect and sell to people.

The next step is to learn how to convert leads in to sales. Finally, you must master customer service so you can retain happy clients.

This is something you may not realize, but every product or service needs a buyer. Knowing who your buyer is will allow you to design your entire company around them.

It takes a lot of work to become a millionaire. A billionaire requires even more work. Why? Because to become a millionaire, you first have to become a thousandaire.

Finally, you can become a millionaire. Finally, you must become a billionaire. You can also become a billionaire.

How do you become a billionaire. It starts by being a millionaire. You only need to begin making money in order to reach this goal.

You have to get going before you can start earning money. So let's talk about how to get started.

What is the difference between passive income and active income?

Passive income refers to making money while not working. Active income requires work and effort.

When you make value for others, that is called active income. It is when someone buys a product or service you have created. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. So they choose to invest time and energy into earning passive income.

Passive income isn't sustainable forever. If you are not quick enough to start generating passive income you could run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, Start now. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

How do wealthy people earn passive income through investing?

There are two options for making money online. Another way is to make great products (or service) that people love. This is what we call "earning money".

Another way is to create value for others and not spend time creating products. This is "passive" income.

Let's assume you are the CEO of an app company. Your job involves developing apps. You decide to make them available for free, instead of selling them to users. Because you don't rely on paying customers, this is a great business model. Instead, you can rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is the way that most internet entrepreneurs are able to make a living. They are more focused on providing value than creating stuff.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

How to make money at home

There's always room to improve, no matter how much you make online. Even the most successful entrepreneurs can struggle to grow and increase profits.

It's easy to get lost in a rut when you start a business. Instead of focusing on growing your company, you can focus only on increasing revenue. You might find yourself spending more time on product development than marketing. Or you could neglect customer services altogether.

It's important to regularly evaluate your progress and determine if you're improving or maintaining the status-quo. These five steps can help increase your income.

-

Increase Your Productivity

Productivity is not just about output. It's also about being able to do tasks well. Find out what parts of your job take the most effort and are energy-consuming, and then delegate these tasks to another person.

If you are an eCommerce entrepreneur, virtual assistants could be hired to manage social media, email management and customer support.

You can also designate a team member who will create blog posts as well as another person who will manage your lead-generation campaigns. You should choose the right people to help achieve your goals faster.

-

Marketing should be a secondary focus.

Marketing doesn't have to be expensive. The best marketers don't have to be paid. They are self-employed consultants, who make commissions on the sale of their services.

Instead of advertising on TV, radio, or print ads, you can look into affiliate programs, which allow you promote other companies' products and/or services. For sales to occur, you don't have necessarily to buy high-end inventory.

-

Hiring an Expert to Do What you Can't

Hire freelancers if you are lacking expertise in a particular area. If you don't have the skills to design graphics, you can hire a freelancer.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be tedious when you work as an independent contractor. It can be particularly tedious if you have multiple customers who want different things.

But apps like Xero and FreshBooks allow you to invoice customers quickly and easily. The app allows you to enter all client information once, and then send invoices directly to them.

-

Increase Product Sales with Affiliate Programs

Affiliate programs can be great because you don't need to have stock. You don't have to worry about shipping costs. To create a link to your vendor's website, all you have to do is setup a URL. Once someone buys from you, you get a commission. Affiliate programs are a great way to build your brand and make more money. It doesn't matter how good your content or services are, as long as they help you attract people.